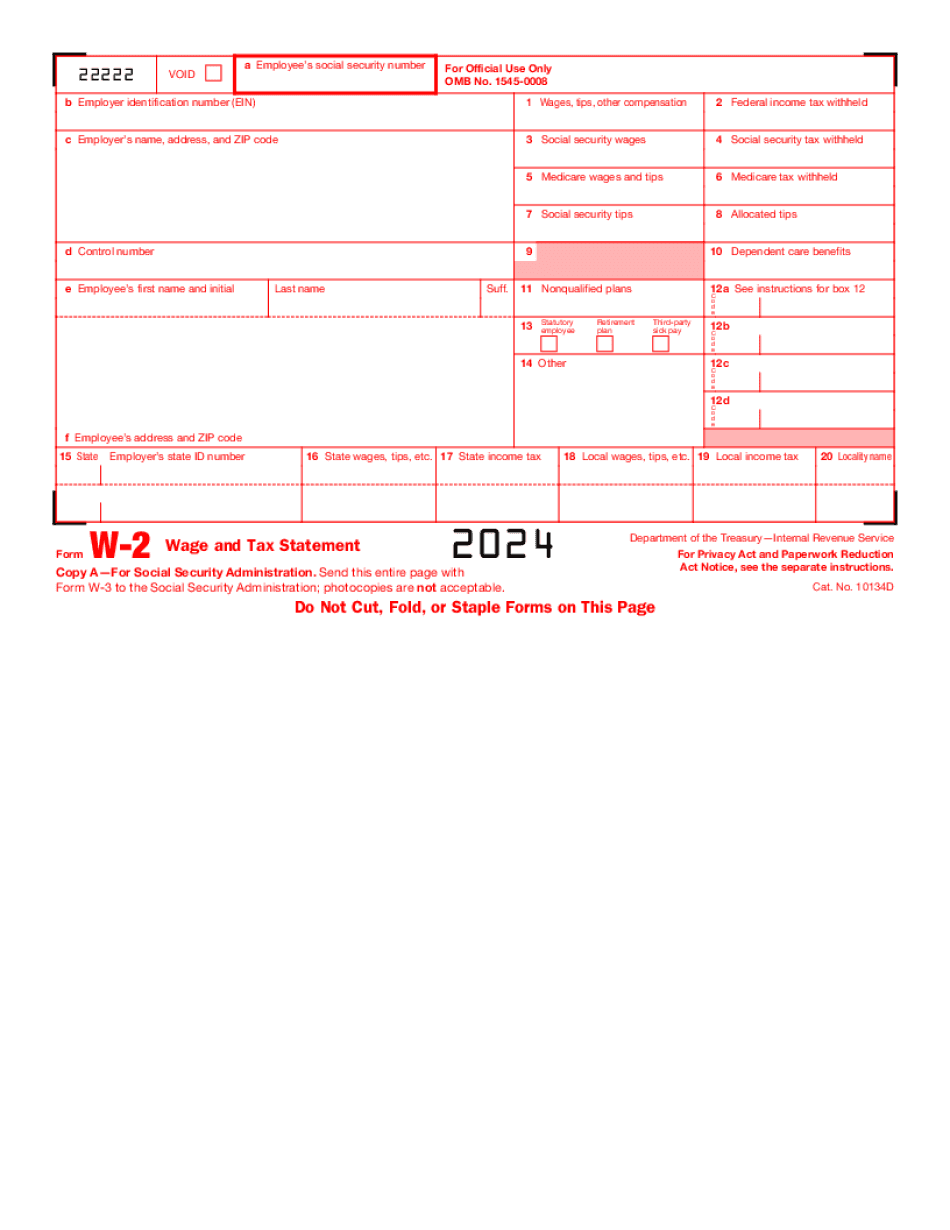

How To Fill Out W2 Form in PDF Online 2024-2025

Show details

Hide details

Ne. See E-filing later. Due dates. By January 31 2019 furnish Copies B C and 2 to each person who was your employee during 2018. Instead you can create and submit them online. See E-filing later. Due dates. By January 31 2019 furnish Copies B C and 2 to each person who was your employee during 2018. Mail or electronically file Copy A of Form s W-2 and W-3 with the SSA by January 31 2019. See the separate instructions. Attention You may file Forms W-2 and W-3 electronically on the SSA s ...

4.5 satisfied · 46 votes

how-to-fill-out-w2-form.com is not affiliated with IRS

Filling out Form IRS W2 online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guideline on how to Form IRS W2

Every person must report on their finances in a timely manner during tax period, providing information the IRS requires as precisely as possible. If you need to Form IRS W2, our trustworthy and intuitive service is here at your disposal.

Follow the instructions below to Form IRS W2 quickly and efficiently:

- 01Upload our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official instructions (if available) for your form fill-out and precisely provide all information requested in their appropriate fields.

- 03Fill out your document utilizing the Text option and our editors navigation to be sure youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the tool pane above.

- 05Make use of the Highlight option to accentuate particular details and Erase if something is not relevant anymore.

- 06Click the page arrangements button on the left to rotate or remove unnecessary file sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to ensure youve provided all details correctly.

- 08Click on the Sign tool and generate your legally-binding electronic signature by uploading its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your report from our editor or choose Mail by USPS to request postal document delivery.

Opt for the best way to Form IRS W2 and report on your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is w2?

All employers face with W-2 form on regular basis. This is a declaration on wages and tax accounting. An individual has to prepare this document and file it to employees and to the US Department of Revenue. The paper includes information regarding the salary and deducted taxes. The objective is to calculate employees withholding allowance.

Streamline the process of creating the form w-2 with the help of digital means. Find a suitable template, fill it out, put an electronic signature and forward to recipients via email, fax or sms.

Stay focused on your primary tasks and forget about paperwork hassles using online blanks.

Follow the instruction to get an idea of How To Fill Out W2 Form.

- 01Choose a blank. Click to view it. Read carefully all the field labels.

- 02Click the Type button. Begin filling lines with appropriate information. Be accurate and pronly truthful data as each details can be easily checked.

- 03Indicate the employees social security number and identification number.

- 04Premployers name, address and ZIP code.

- 05Enter control number.

- 06Then write the employees full name, initial, address and ZIP.

- 07Starting from the field 1 to 20 prinformation regarding the wage, social security, medicare, income tax and other details.

- 08Put the current date.

- 09Add your signature to the file by drawing, typing or uploading.

- 010Download the document to your device.

- 011Send it to the recipient.

Enhance your workflow with the help of w-2 digital form. Enjoy the convenience and simplicity in contrast to tedious paperwork routine.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form IRS W2?

The IRS W2 form is used to show your business expenses and income (income you make from your employment, income you make from business, and so on). A business' business income must be itemized on Form 1040, Schedule A.

For businesses with employees, the W-2 is used to show the net wages (profit received minus the cost of benefits), as well as withholding from the employee's pay.

Learn more: IRS W-2 Requirements for Small Business.

Who should complete Form IRS W2?

If you're going to use Form W2 for some other tax-related activity, such as buying or selling stock, getting a mortgage, or paying for a business loan, then you should file Form W-2. The following people cannot file Form W-2:

If you are self-employed, self-employment taxes need to be withheld from your pay. Self-employed people must file a tax return that includes Form 1040, Schedule C. Generally, you are required to file a Schedule C if your gross income for any one month is more than 200,000. But see the discussion below for exceptions (under “Exception C.”).

If you are a married filing jointly and filing a joint tax return, you are a self-employed individual. In that case, the following people can file Form W2, even without gross income:

You cannot file Form W-2 if you have any income for the calendar year from any source other than wages.

You cannot file Form W-2 if you have more than 200,000 of net self-employment income for the calendar year.

What happens if someone files Form W2 when they should file Form 1040?

If you are the spouse or dependent of a taxpayer who files Form 1040 and you are the person who should be filing Form 1040, you cannot file a separate tax return for the year, and you should not file a Form W-2. However, the person who should file Form 1040 may claim a deduction for any reimbursed business expenses, including business related legal expenses (such as paying a lawyer to represent them) or business related employee expenses (such as paying for vacation time or other employee benefits).

When should I file my return?

You should file a return for any tax period in accordance with IRS instructions for that tax period. IRS instructions are available online, in the IRS Pub. 519, Tax Guide for U.S. Citizens and Resident Aliens Abroad, and in the publications section of the IRS website.

If the tax period you are filing a U.S. tax return for doesn't have an official due date, you must file a return by the due date of the return (usually April 15) at the latest.

A return is filed using Form 1040X, 1040A, 1040EZ, or 1040NR, depending on the type of return.

When do I need to complete Form IRS W2?

Complete form W-7.

Do I need to send Form W-7 if my employer is issuing Form 1099?

Yes. Generally, employers issue Form 1099 to employees based on the amount of their wages paid. If an employer issues a Form W-7 to employees, the employer must issue to the filer a completed Form W-10 with an appropriate explanation of how its wages are estimated. If no explanation is included, and the Form W-10 is filed with the IRS, filers may want to include Form W-1 as required on the Form 1099.

Where can I obtain a copy of Form W-7?

You can receive a free copy of Form W-7 at any IRS address. You can obtain the form from your employer/employee relationship coordinator at payroll.gov/federal tax return. Furthermore, you can also order a copy of Form W-7 in many of our retail stores in the U.S. or you can click the “Mail Online Request” link on the Forms and Publications link on the IRS website. Furthermore, you can also click this link to access Form W-7 electronically on our IRS website.

Who can I contact for the W-7 if I am an independent contractor?

Contact IRS with the information on your employee. You may be able to receive a Form W-7 if the W-7 is filed against your tax return. You may also be able to obtain a free copy of Form W-7 at any IRS address. Furthermore, you can also order a copy of Form W-7 electronically on our IRS website. The information on this page is not intended to be legal advice or to replace the terms and conditions that apply to IRS Forms W-7, 1095, 1099, or Form 1040, or to any applicable state tax, social security, Medicare, employee, or employer social security tax, and income tax returns (not including any amount received for tax preparation).

I am an independent contractor. Do I need to make an initial application?

Yes. Before you issue your W-7, you must first apply for Form 1099-MISC. Once accepted, you are then eligible, on a permanent or temporary basis, to use Form W-7 as a basis for an amount to be included in gross income.

Do I have to apply to use Form W-7 to deduct, for example, business expenses?

No.

Can I create my own Form IRS W2?

Yes. You can use this form if you are enrolled in, or eligible for, the Supplemental Medicare Income Program (Part D), the Department of Veterans Affairs (VA), or the State Children's Health Insurance Program (SHIP). If you are enrolled in Medicaid or any other health care program, please review our Frequently Asked Questions (FAQ) first. We can also answer any specific questions you may have.

You can use this form to report and obtain the following information:

your name, social security number, and your annual income,

inclusion of any wages or income other than for medical care,

the total amount of earnings from self-employment, business, or other sources in the last 6 months, and

Your marital or common law partner's name, marital status, and current federal income tax filing status.

How do I calculate my Form W-2 Wages?

The Social Security Administration uses the Bureau's Form W-2 Wage and Tax Statement to calculate your earnings for the year. In addition, you will need to provide the name and Social Security Number (SSN) of every spouse, child, or parent, and their age. Include in your report the number of each parent(s) who lived in the home and number of children who attended school in either elementary or secondary school. We will deduct the following amounts from your W-2 wages:

All amounts received from your employer. Include in your report the SSN of each employee, whether in the employer's firm, in the firm's subsidiary, or in any other unit.

Amounts from your employer or a joint employer, when all the income is to be reported in the same period. Don't include in your report amounts received from your employer or a joint employer in which you do not have any interest, however you may report the amounts of other joint employers that are shown in the wages reports for all your joint employers.

The value of the business and other assets that your spouse has owned. Include in your report:

the date of acquisition,

the name of the owner,

the value at purchase, and

The date it passed to you. If your spouse's assets include assets sold under a death or dissolution transaction, report the date of disposition.

If you have to file a U.S. Federal Income Tax Return for the year, we also require you to report your earnings from self-employment.

What should I do with Form IRS W2 when it’s complete?

When you complete Form W-2 in one of the following ways:

From the Internet: Click on “Complete a Form” and fill in all or part of one page for your tax return. You can print out your completed W-2 without sending an e-mail or fax.

By phone: Click on “Get a Copy of a Paper Product,” and you'll be able to enter your information on the form on-line.

By written letter: If you're on-time and don't miss deadlines, you can send a written statement to us after you complete your Form W-2. A statement will be mailed the next business day if no e-mail or fax is received by us within three business days of the e-mail or fax. For more information about completing your tax return on a paper product, check with the IRS in your area.

To save paper, we recommend submitting your completed Form W-2 through the mail if it's due on or before March 15. However, you may use it as soon as April 15, 2018, if it's due on or after March 15.

You can also use your Form W-2 for a refund if:

Your due date in connection with the return was: On or before March 15, 2018.

On or after March 15, 2018. You didn't receive a refund if you: Received a refund or a reduction of a portion of your tax that was paid through other means within 60 days of the time you filed the return.

You can have the IRS refund your refund or reduce your tax payment, even if you need it later.

Can I make an adjustment to a Form W-2 before it's filed, if I use a different name on the return?

As long as your name, Social Security Number (SSN) and date of birth appear the same, you can use Form SS-4 to make an amendment to your Form W-2. Click on the “Advance Amendment” link on form SS-4 to learn more.

Form W-2 and the Form 1098

Can I use both a Form W-2 and an IRS form 1098 to fill out my tax return?

Yes. Both forms must be completed at the same time. The IRS may choose to send your refund for you using the form 1098 in an electronic format.

How do I get my Form IRS W2?

If you are self-employed and received a Form W-2 for income from self-employment, you should submit a copy of it along with your return to the IRS.

What types of information should be in a self-employment W-2?

If your employer reports your personal income, then a Form W-2 is required to calculate your self-employment income. However, if your business income is shown on Schedule C or D then you do not need to keep a copy of your W-2 (unless you are an S corporation).

You do not need to keep a copy of your W-2s for:

Self-employed persons who are paid under a contract or on a commission basis.

The following types of self-employed people include:

Those who paid self-employed self-employment taxes during the pay period.

Those who received S corporation wages to which they did not contribute.

Income from sales of inventory.

Amounts paid to your clients for services.

Fees for insurance, property and casualty insurance premiums.

Amounts transferred or lent to you on a loan.

Amounts transferred or lent to you on a gift.

Amounts transferred or lent to you on a death benefit.

Amounts transferred or lent for casualty or liability insurance.

How long do Form W-2s last, and how much can I request to be paid in advance?

Form W-2s, Form 1099-B and Form 1099-MISC are for one year from the date you receive them.

You can request payment from an installment agreement. For more information on installment agreements, see IRS Pub 519, Tax Withholding and Estimated Tax, for more information.

I'm an employee. Do I need to keep a copy of my W-2 for income tax?

Yes.

If you are self-employed, you and the employer should enter into a written agreement to report your personal employment income with the IRS. The agreement contains an address at which you can obtain Forms W-2, 1099-B and 1099-MISC when you file your return.

What documents do I need to attach to my Form IRS W2?

A paper trail must accompany all tax returns from the following information bases: Employer Forms (Form 1040, 1040A, 1040EZ, 1040AES, 1040NR, etc.).

Social Security Numbers (SSN), Employment Tax Credits, Child Tax Credit (CTC), or Employment Allowance.

Payroll statements. If you have not received your W-2 by February 15, mail or fax the W-2 or information report, Form 4868. Send one copy of each paper copy of Form 1040 or 1040A, 1040EZ, 1040AES, 1040NR, 1040SSN, 1040SSN-IRS and 1040NR-IRS, to the following address: Employment Tax Appeals Unit, P.O. Box 611, Sioux Falls, SD 57103.

What forms of payment should I use as proof of income? Payroll checks and other receipts should be used only for amounts received by the employee.

If a copy of a W-2 is provided by your employer, there is no need to use the original, because the employer-supplied W-2 only shows the amount reported on the Form 1040, 1040A, 1040EZ, 1040AES, 1040NR, 1040SSN, or 1040NR-IRS for the current year.

If a copy of an individual Form W-2 is provided, use only the correct address listed on the individual's Form W-2 as the correct address to send the Forms W-2 and any appropriate supporting documentation to the Income Tax Appeals Unit.

What documents do I need to submit to the income tax hearings? All documents you provide to the Income Tax Appeals Unit are confidential and confidential information will be kept confidential.

The only exception to the confidentiality policy is confidential information provided for use at your income tax hearing. The Income Tax Appeals Unit will not release your confidential documents to anyone outside IRS except in the event of a “national security” situation. The Income Tax Appeals Unit is the only IRS entity that can accept confidential documents. If you are requesting confidential information of another taxpayer, we encourage you to request that the other taxpayer provide personal information directly to IRS, so you can receive the confidential information.

Your confidential documents are NOT public record and may not be placed in the public record. The confidential information you submit to request confidential documents may be removed or modified at any time.

What are the different types of Form IRS W2?

Each Form W-2 is a two-part series of figures:

a. Line 11, “Wage and Salary” which is the payment amount.

b. Line 20, “Employment Income and Self-Employment Income” which is the self-employment income.

Line 21 (the rest of the line) is a statement that the employee paid tax on these forms. However, they do not list what the income was.

How does one calculate the Form W-2 wage?

This depends on many factors such as:

The type of work done

The number of days worked in a given year

The employee's annual salary

Whether certain other deductions are taken into account

Employees are generally responsible for calculating the amount of earnings in this manner (see the Employee's Guide to Payroll Deductions)

How does one calculate the Form W-2 self-employment?

This depends on many factors such as:

Employees' self-employment tax rate

State business taxes

Employers' business taxes

Employees' federal tax rates

When does Form W-2 need to be filled out?

The IRS sends Form W-2 to the employee as soon as it has completed the employee's initial Form W-2 filing.

How much of a Form W-2 does the employee need to have?

It is not required for all employees to receive a Form W-2 every year. The IRS requires certain employees to have a certain percentage of their earnings reported to the employer on Form W-2. However, this amount is not included in the employees' total income and therefore can't affect the income of the employee directly.

This total doesn't include the first 5,000 of income from self-employment (the wages don't count, only the self-employment income will be reported) but does include 125,000 of wages received prior to the filing of Form W-2. This amount has to be reported on Form W-2 for the year that includes the year in which the wages were paid. The Form W-2 reporting is complete for all wage payments of 125,000 or more. Employees who received less than 125,000 of wages must complete the self-employment tax portion of their W-2.

How many people fill out Form IRS W2 each year?

The IRS has no current figure for the number of returns it receives on the W2. However, in 2007 the agency estimated that it would receive 6.9 million W2s, and, in the fiscal year of fiscal 2008, its total IRS processing capacity was about 5.2 million W2s. The agency has taken the position that these numbers represent the number of returns that are processed, not those that are accepted for processing—the latter category is far higher. It has said that it anticipates processing about 7 million W2 forms annually by calendar year 2013. The number of W2 return filings from nonresident aliens is unknown, but many experts argue (as the IRS has said) that such returns are a small fraction of the total number submitted and are most probably being processed by nonresidents or by companies whose executives are nonresident aliens who file the W2 form using their U.S. addresses.

Do I have to worry about paying taxes on income from foreign trusts?

The general rule is that U.S. tax laws apply to income derived from foreign trusts. For tax year 2012, the U.S.-based trustee of a foreign trust, who elects to have that trust treated as a U.S. trust (a paper transfer of title) can treat all income from this trust as wages for income tax purposes. As of February 6, 2012, in the case of foreign trusts, a paper transfer of title would be tax-free. Foreign trusts are not subject to U.S. withholding tax. This position will change in the future if Congress approves special withholding rules for foreign trusts. For more information relating to the application of foreign trust provisions to U.S. income, please contact an experienced tax lawyer in your jurisdiction.

How do I determine how much income from my income earned abroad will be taxed?

You should get a Form 1098-S with your return, if you received any income during the year. If you received more than 600 with respect to the foreign income, you may be subject to a U.S. tax withholding of 3% of the taxable income (about 1,100).

Other rules

How does the exclusion of foreign earned income affect my U.S. personal tax deductions?

The exclusion of foreign earned income affects your U.S. earned income and U.S. tax deductions. If you are a U.S.

Is there a due date for Form IRS W2?

Form W-2 is a single page receipt which is filed with your monthly statement or with your tax return and typically must be filed by the due date of the tax return. There is no expiration date for Form W-2.

There is no expiration date for Form W-2. How do I find my Form 1099-R report? — It takes a few minutes to calculate your Form 1099-R. You do not need to contact us for Form 1099-R — you can use the IRS Form 1099-R calculations you should have received on your quarterly or annual tax return.

Return to top of form (this page) | Return to Top

Form SSA-1099-B

What are these payments and allowances used for? — This is the Social Security Administration tax filing fee. This form is filed by you and your dependent child, and it identifies your dependent child.

How do I file this form? — You fill out and file one Form SSA-1099-B in your home state. If you do not want to file Form SSA-1099-B at home, you can complete the Form 5498F and file it using the electronic filing option one file.IRS.gov. There are other electronic filing options available to you.

Form 609 and Form 8809

What are these payments and allowances used for? — These two forms are used to report the monthly earnings of your dependent employee.

How do I file these forms? — You will need to file both of these forms with your state Department of Labor. You should file the Form 609 for each payment.

There are several ways you can file the forms. Do a free search through your local Social Security office to see if they are currently releasing these forms.

Also contact your nearest Social Security office. Depending on where you live you may be able to file the forms online.

Report any earnings of your worker who made more than 2,800 during the tax year on Form SSA-1099-S, Annual Report of Earnings of Independent Workers. Report these earnings on Form SSA-1099-E. Report the employer deductions listed on the Form 1099-R and the employee deductions listed on the Form 609 on Form 8809.

Your dependent child may be eligible for certain exemptions from the withholding tax. For more information, contact your local Social Security office.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here